| A Turning Point

European summers historically have not been extremely hot. Europeans typically have not depended on air conditioning for home comfort. In comparison, the demographics of the USA changed greatly as a result of AC as the quality of life improved in subtropical and tropical regions.

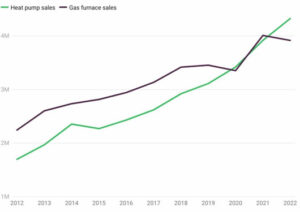

Now, with respect to heating, a turning point may have been reached in the USA. Heat pump sales surpassed gas furnace sales in the USA in 2022, according to AHRI monthly shipment data [6]. (See Fig. 1.) This increase in sales has attracted new players to the market in the USA. Many more companies exhibited heat pumps of one form or another at the AHR Expo in 2023 compared to 2022.

The exhibit space was dominated by global OEM giants such as Daikin, Gree, Haier, Hitachi, LG, Midea, Mitsubishi, Samsung, and others. There were also USA-based OEMs with various models of heat pumps on display. Many of these global giants may just be testing the USA markets to ascertain which products are suitable for North American operations.

It is noteworthy that in 2022 Midea America and Gradient were selected by New York Power Authority (NYPA) to develop new heat pump technology and initially are contracted produce 30,000 new heat pump units for use in New York City Housing Authority residents [7] [8].

Midea is just one among many partners participating in the Cold Climate Heat Pump Challenge working with the U.S. Department of Energy (DOE) to establish consumer incentives to encourage adoption. The Challenge is currently focused on residential, centrally ducted, electric-only heat pumps. There are two segments: one for a CCHP optimized for 5 °F (–15 °C) operation (“5 °F challenge”) and the other for a CCHP optimized for –15 °F (– 26 °C) operation (“– 15 °F challenge”). Detailed challenge specifications are available online [9].

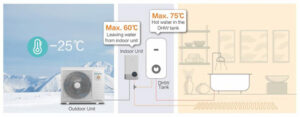

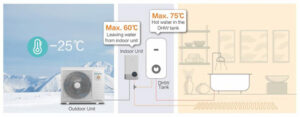

Figure 2 – A single monobloc ASHP can provide domestic hot water as well as hydronic space heating. (Courtesy of Hisense.) |

|

| At the 2023 AHR Expo, HiSense (Qingdao, Shandong, China) touted a low energy system for cooling, heating and domestic hot water, delivering outstanding performance even at extreme outdoor temperatures. The company guarantees stable operation even with outdoor temperatures as low as –15 °F (– 26 °C), effectively satisfying the heating demand in extremely cold areas [10].

The HiSense product boasted low-GWP R32 but conventional R410A refrigerants were also common at the AHR Expo. The one major difference between the recent 2023 ISH Expo (Frankfurt, May 2023) and the 2023 AHR Expo was the lack of R290 ASHP products at the AHR Expo compared to ISH Expo. An exception was the PHNIX (Guangzhou, Guangdong, China) Greentherm Air-to-Water HP for space heating and domestic hot water. PHNIX claims stable running at ambient temperature down to –15 °F (– 26 °C) using R290 natural refrigerant [11].

Europe is on a faster track to phase out HFC refrigerants and also to permit the use of R290 in outdoor monobloc evaporators for ASHPs. This was evident in the presence of many units containing R32 as well R290 refrigerant at the ISH Expo.

The evaporators for the ASHPs on display at the AHR Expo typically were comprised of copper tubes with diameters of 9.52 mm (3/8 in.) or 7 mm. Yet there were several companies offering heat exchangers made with 5 mm diameter copper tubes. For example, Amber Enterprises (Haryana, India) [12], Bohn (Querétaro, Mexico) [13], Indus (Sharjah, United Arab Emirates) [14] and Lordan (Kfar Szold, Israel) [15] were promoting the manufacture of coils based on 5 mm or 7 mm diameter copper tubes [12-15].

Heat pump designs on display at the AHR Expo to some degree reflect the existing housing stock and the climate zones. As an economical alternative to ground source heat pumps (GSHP), different types and sizes of air source heat pumps (ASHPs) accounted for the wide array of products on display. Types of ASHPs include Air-to-Air (ATA) and Air-to-Water (ATW) heat pumps. Another distinction is made between split system heat pumps and (outdoor) monobloc heat pumps.

Also, midsize systems for multifamily homes and light commercial buildings were prevalent, for example, 20 refrigeration ton (RT) systems (equivalent to 240,000 BTU/h, or 70 kW). These systems can provide space heating and domestic hot water in apartment complexes. They lend themselves well to variable refrigerant flow (VRF) and the use of large outdoor evaporators. Indeed, they may be the low-hanging fruit in the push toward decarbonization. |

|

| Especially for retrofits, where the heat pump replaces a central furnace, a closed loop system (secondary loop) may be installed between the heat pump and the ductwork. A closed loop is a circulation loop where a particular medium (water, glycol, etc.) is continuously circulated around a system of piping.

In this case, the fluid passes inside the tubes of an air handler and forced air picks up the heat and distributes it through the home. This cascaded system combines an ATW heat pump with an air handler and the net effect is the same as an ATA heat pump.

An ATW heat pump is suitable for replacing the boiler in hydronic heating systems, which distribute hot water through pipes. Hydronic space heating is accomplished through conventional radiators, in-floor radiant heating or floorboard heaters. In the case of an ATW heat pump, the condenser may take the form of a brazed plate heat exchanger, which transfers heat from the hot compressed refrigerant to the water for use in space heating or domestic hot water.

For ASHPs with a secondary loop, the refrigerant path is restricted to the outdoors. These self-contained units are commonly referred to as monoblock heat pumps, or “monoblocs.” (See Figs. 2 and 3.)

Monobloc ASHPs can be used for space heating or domestic hot water (DHW) or both. These have different temperature requirements, and their efficiency depends on the outdoor temperature. Heat pumps that are specifically designed to be effective in cold climates are generally referred to as Cold Climate Heat Pumps (CCHPs).

Monobloc ASPHs with small-diameter copper tube heat exchangers have the potential to reduce refrigerant charge and enable the use of natural refrigerants such as R290, which have an ultralow GWP and do not pollute the environment.

Figure 3 – An outdoor ATW HP can be coupled with a multi-function tank to provide domestic hot water and space heating as well as space cooling and tap water. (Courtesy of PHNIX.) |

|

| Cold Climate Heat Pumps

Cold climate heat pumps (CCHPs) could be a game changer in the adoption of heat pumps. CCHPs raise the possibility of drastically reducing the energy requirements for heating in large swathes of the Northeast and Midwest. They deliver high COPs for most heating days when temperatures are near freezing.

In other words, they are energy amplifiers even at freezing temperatures. This is seen on a phase diagram where the work done by the compressor is multiplied by the heat absorbed by the refrigerant at the outdoor evaporator.

One way to make CCHPs even more efficient in gathering heat from a cold outdoor ambient is to use smaller diameter copper tubes. This has been demonstrated in many, many designs, As few as ten years ago, heat pumps were made with 7 mm diameter copper tubes. However, as coil makers mastered the production of heat exchangers with even smaller diameters tubes, it was realized that such coils extend the range of operation of such heat pumps (Fig. 4). |

|

Figure 4 – Smaller diameter copper tubes (5 mm or 7 mm) are in demand as OEMs discover their advantages in a variety of applications including evaporators for monobloc CCHPs. (Photograph Courtesy of Lordan.) |

| Conclusion

Heat exchanger engineers and policy makers from around the world met at the triannual IEA Heat Pump Conference in Chicago, and they will also meet at the quadrennial IIR International Congress of Refrigeration in August. It can be expected that the pace of product innovation, ramping up of production and market expansion will only increase in the coming years and the best designs will win over the market!

Right now, it is still too early to pick the winning technologies and companies but it should be noted that ATW HPs have many benefits for space and water heating. The industry is bracing for a period of rapid transition, comparable to the transition to propane in the refrigeration industry and the perfection of R744 supermarket refrigeration systems.

Much of this change will be driven by the existence of a robust supply chain, one that can meet the demand for smaller diameter copper tubes as well as the heat exchangers made from these tubes.

On thing is certain. Cold climate heat pumps are coming to America … perhaps sooner than anticipated. |

|

|

|

|

A Sea Change is Now Happening in Heating

A Sea Change is Now Happening in Heating